Offshore Trust Services Fundamentals Explained

Wiki Article

The Basic Principles Of Offshore Trust Services

Table of ContentsOffshore Trust Services Things To Know Before You Get ThisOffshore Trust Services - An OverviewThe 30-Second Trick For Offshore Trust ServicesExamine This Report on Offshore Trust ServicesThe Buzz on Offshore Trust ServicesThe 8-Minute Rule for Offshore Trust ServicesFascination About Offshore Trust ServicesThe Ultimate Guide To Offshore Trust Services

Exclusive lenders, also bigger personal firms, are extra amendable to resolve collections versus borrowers with complicated and effective asset protection plans. There is no possession security plan that can prevent an extremely inspired lender with limitless money and also patience, but a well-designed offshore depend on commonly gives the borrower a beneficial settlement.Offshore counts on are not for every person. For some individuals dealing with difficult lender troubles, the offshore depend on is the ideal option to secure a significant amount of possessions.

Debtors might have much more success with an overseas count on plan in state court than in an insolvency court. Judgment financial institutions in state court litigation may be daunted by offshore possession protection trust funds as well as might not look for collection of properties in the hands of an overseas trustee. State courts do not have territory over offshore trustees, which suggests that state courts have limited treatments to buy conformity with court orders.

The 10-Minute Rule for Offshore Trust Services

A bankruptcy borrower should give up all their assets and lawful rate of interests in home wherever held to the personal bankruptcy trustee. An U.S. insolvency judge may oblige the insolvency borrower to do whatever is needed to transform over to the personal bankruptcy trustee all the borrower's possessions throughout the globe, consisting of the debtor's valuable interest in an offshore count on.Offshore possession security trusts are much less reliable against Internal revenue service collection, criminal restitution judgments, and also household sustain commitments. The courts may attempt to compel a trustmaker to dissolve a depend on or bring back depend on possessions.

The trustmaker needs to want to surrender lawful civil liberties and also control over their trust fund assets for an offshore depend on to properly shield these properties from united state judgments. 6. Option of a professional and trusted trustee that will certainly defend an offshore trust fund is a lot more important than selecting an offshore count on territory.

9 Easy Facts About Offshore Trust Services Shown

Each of these countries has count on laws that are positive for offshore asset protection. There are refined legal differences among offshore trust jurisdictions' regulations, yet they have extra features in typical.

Official data on depends on are difficult to come by as in many offshore jurisdictions (and also in the majority of onshore territories), depends on are not required to be registered, nevertheless, it is thought that the most common usage of overseas counts on is as part of the tax obligation and financial preparation of affluent individuals and their family members.

The Best Strategy To Use For Offshore Trust Services

In an Irreversible Offshore Trust might not be altered or liquidated by the settlor. An allows the trustee to choose the distribution of profits for various classes of beneficiaries. In a Fixed depend on, the distribution of revenue to the beneficiaries is repaired as well as can not be transformed by trustee.Confidentiality and also anonymity: Although that an offshore count on is officially registered in the government, the events of the depend on, possessions, and the conditions of the count on are not tape-recorded in the register. Tax-exempt standing: Assets that are moved to an overseas trust fund (in a tax-exempt overseas area) are not exhausted either when moved to the count on, or when transferred or rearranged to the recipients.

Offshore Trust Services - An Overview

This has actually additionally been done in a number of United state states., after that the trustees have to take a favorable role in the affairs on the company., but stays component of depend on law in many usual law territories.Paradoxically, these specialist forms of trust funds appear to occasionally be made use of in connection with their initial designated uses. STAR trust funds appear to be made use of a lot more often by hedge funds developing shared funds as system depends on (where the fund managers want to get rid of any type of commitment to attend conferences of the firms in whose safeties they spend) and VISTA depends on are frequently made use of as a component of orphan structures in bond concerns where the trustees want to divorce themselves from monitoring the releasing automobile.

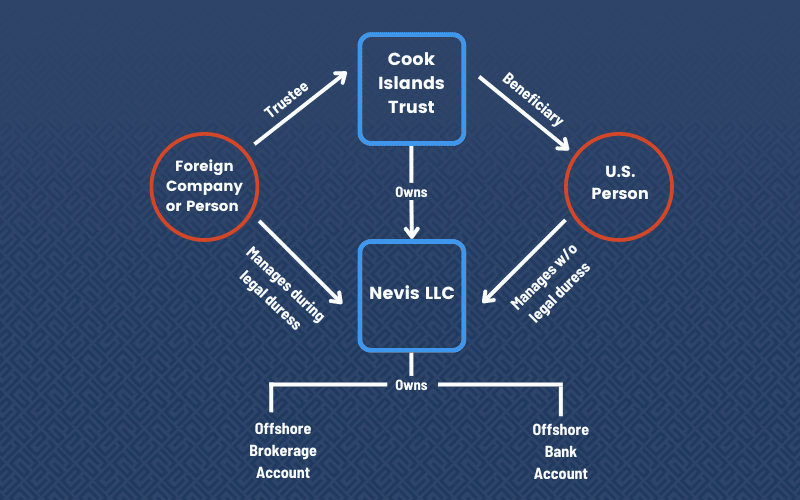

Specific jurisdictions (especially the Cook Islands, but the Bahamas additionally has a types of property security count on) have actually supplied special trust funds which are styled as possession defense trust funds. While all depends on have an property security element, some jurisdictions have actually established regulations trying to make life tough for financial institutions to push insurance claims versus the depend on (for instance, by offering for particularly short restriction durations). An offshore trust is a device made use of for property security and also estate preparation that functions by transferring assets right into the control of a lawful entity based in another country. Offshore trust funds are irrevocable, so trust proprietors can't recover ownership of moved assets. They are likewise complicated as well as pricey. Nevertheless, for people with better obligation issues, offshore trust funds can provide security and also greater personal privacy in addition to some tax obligation advantages.

Offshore Trust Services - An Overview

Being offshore adds a layer of defense as well as privacy as well as the capacity to take care of taxes. For instance, because the depends on are not situated in the USA, they do not have to follow U.S. laws or the judgments of U.S. courts. This makes it much more tough for financial institutions and also plaintiffs to go after insurance claims versus possessions held in offshore trusts.It can be challenging for 3rd parties to determine the properties as well as owners of offshore depends on, that makes them help to privacy. In order to establish an offshore trust, the very first step is to pick a foreign country in which to situate the trusts. Some prominent areas consist of Belize, the Chef Islands, Nevis and also Luxembourg.

9 Easy Facts About Offshore Trust Services Shown

Transfer the properties that are to be secured right into the trust fund - offshore trust services. Offshore depends on can be helpful for estate preparation as well as asset security yet they have limitations.Revenues by assets positioned in an overseas depend on are free of United Related Site state tax obligations. United state owners of overseas depends on also have to submit reports with the Internal Earnings Solution.

The Buzz on Offshore Trust Services

Corruption can be a problem in some countries. In enhancement, it's crucial to choose a nation that is not likely to experience political agitation, regimen change, financial turmoil or fast adjustments to tax obligation plans that could make an overseas count on less beneficial. Ultimately, asset security trusts usually need to be established prior to they are needed - offshore trust services.They likewise don't flawlessly protect against all insurance claims and might expose proprietors to dangers of corruption as well as political instability in the host nations. However, overseas counts on are practical estate planning and asset security tools. Recognizing the appropriate time to make use of a details depend on, and also which trust would certainly give one of the most profit, can be confusing.

Think about utilizing our resource on the trusts you can utilize to benefit your estate planning., i, Supply. com/scyther5, i, Supply. com/Andrii Dodonov. An Offshore Trust is a traditional Count on shaped under the regulations of nil (or reduced) tax Worldwide Offshore Financial Facility. A Trust fund is an authorized game strategy (comparable to an agreement) whereby one individual (called the "Trustee") according to a succeeding individual (called the "Settlor") grant recognize and hold the home to aid different article people (called the "Recipients").

Report this wiki page